The term 1031 Exchange is defined under section 1031 of the IRS Code. To put it simply, this strategy allows an investor to “defer” paying capital gains taxes on an investment property when it is sold, as long as another “like-kind property” is purchased with the profit gained by the sale of the first property.

The IRS Outlines several rules that must be followed for a transaction to qualify for tax deferral through a 1031 exchange. Rules address which types of real estate can be utilized for an exchange and how proceeds from the sale of the relinquished property must be handled throughout the exchange, how and when replacement property must be identified, and required timelines for closing on the replacement property.

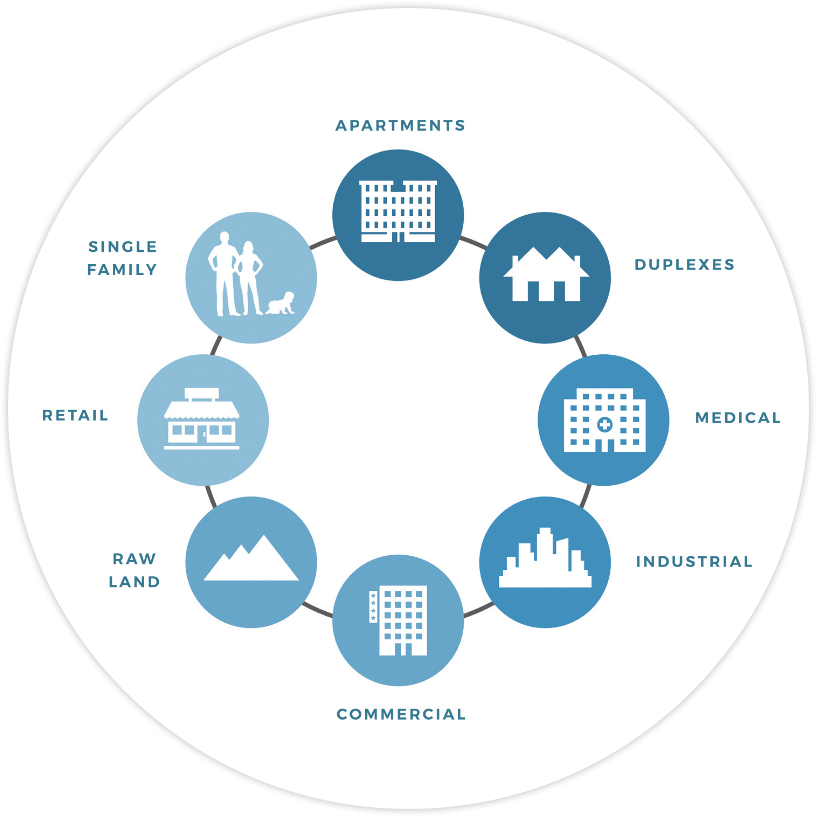

The investment properties exchanged must be “like kind” meaning they are the same in nature and character.

The value of the replacement property must be equal to or greater than the value of the relinquished property to obtain a full deferral.

The title of ownership on the replacement property must be the same as on the relinquished property.

According to IRS Section 1031, both the relinquished and the replacement properties must be held for investment purposes, and they must be “like-kind” properties. Property held for investment purposes can include a multitude of real estate types, but most are rental properties or commercial real estate. Personal residences and vacation homes that are not utilized primarily as rentals do not qualify for a 1031 exchange. “Like-kind” simply refers to the fact that investment real estate must be exchanged for investment real estate within the United States.

The IRS outlines three ways that a replacement property can be identified

Allows an investor to identify up to three potential replacement properties and close on any or all of them to complete the exchange.

Allows any number of properties to be identified as long as their total value does not exceed twice the value of the relinquished property. As in the case of the 3-Property Rule, once identified, any or all of the potential replacement properties can be purchased to complete the exchange.

Allows an investor to identify an unlimited number of properties, but the investor must purchase 95% of the aggregate fair market value of all of the properties identified.

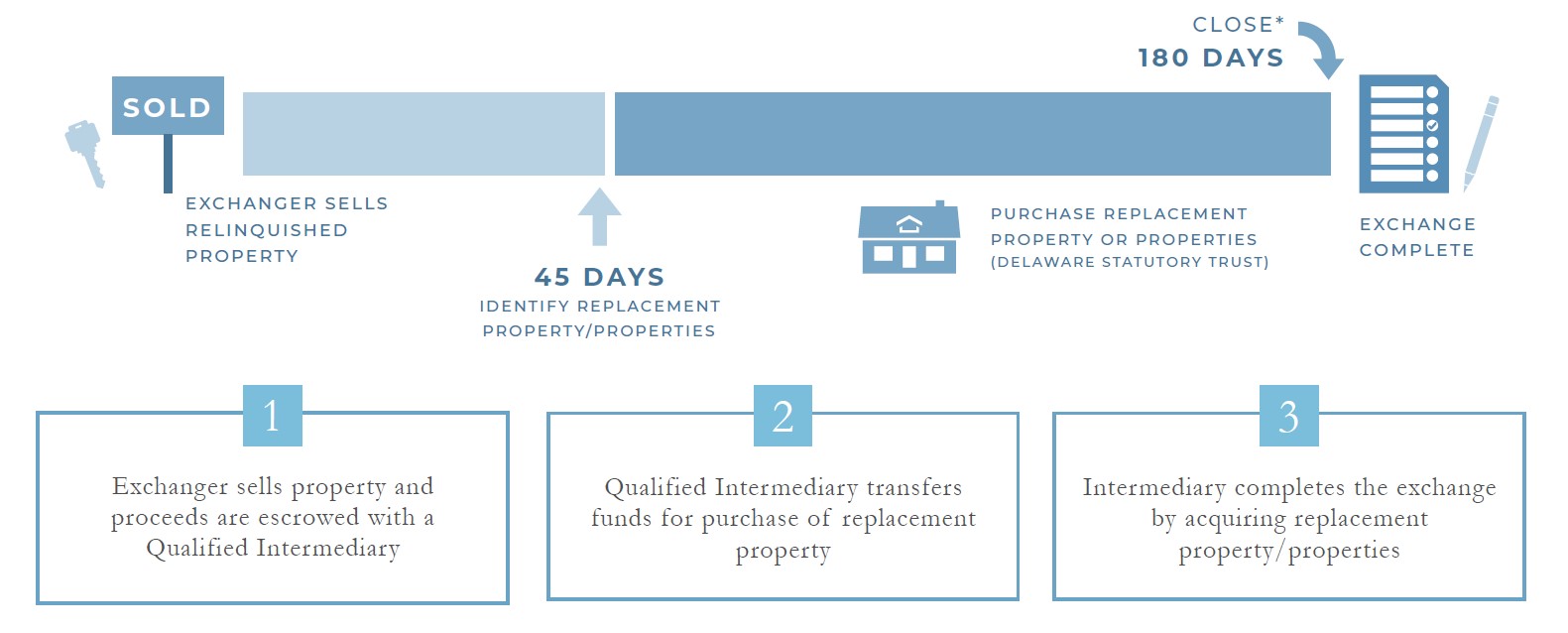

The “Exchange Period”

The most important deadlines for a 1031 exchange are the identification and closing dates. Weekends and holidays are included in the deadlines. Investors must adhere strictly to the timeline in order to complete a successful 1031 exchange.

If you complete the exchange successfully within that time, you will qualify to defer taxes on your capital gains for the investment. The first 45 days of the 1031 exchange are crucial, since you must complete thorough research and due diligence within the time window. To navigate the process efficiently, have a plan before you get started.

If an investor takes direct receipt of the proceeds from the sale of the relinquished property, a 1031 exchange cannot occur. The Treasury provides safe harbor guidelines that allow an investor to use a Qualified Intermediary (QI) to avoid taking direct receipt of the funds in an exchange transaction. A QI is any independent party that facilitates tax deferred 1031 exchanges in accordance with IRS guidelines

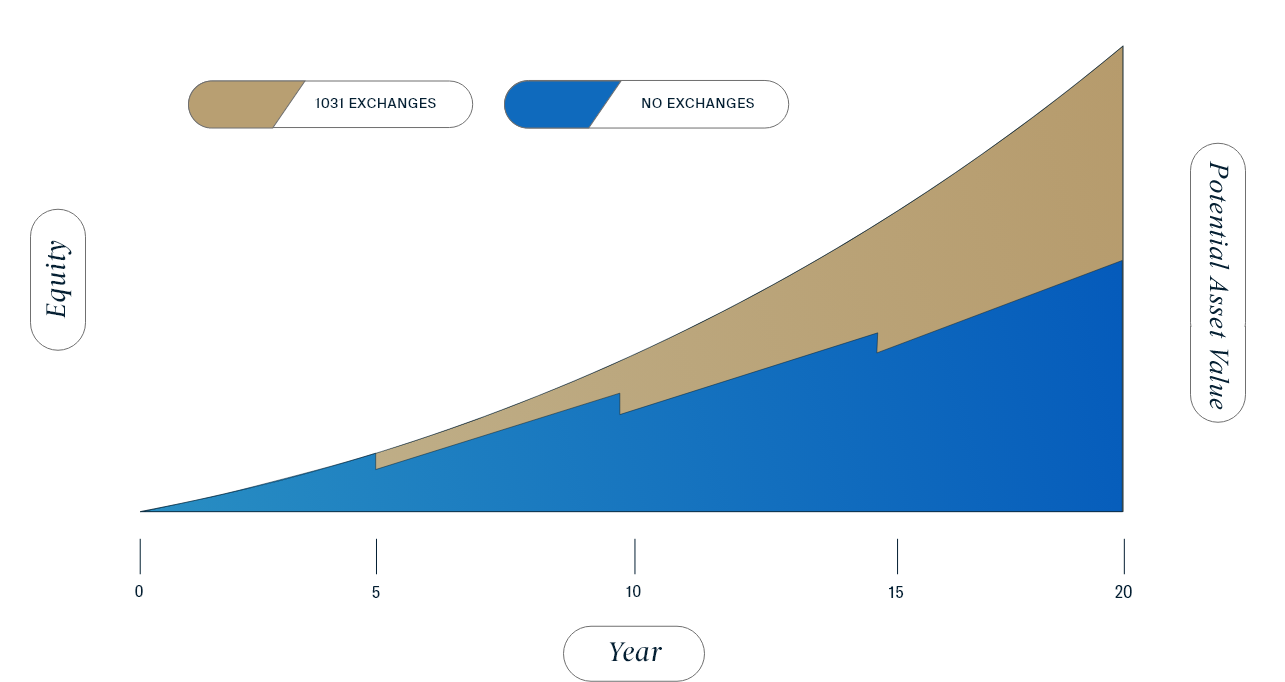

The chart on shows the potential tax savings you could experience by utilizing a 1031 Exchange. This is an example, it is important to know your individual tax situation.

As a real estate investor, you are able to perform an unlimited number of exchanges throughout your lifetime. By not taking a tax hit every time you sell a property, your ability to strive to generate wealth increases exponentially. Without a doubt it is the single most valuable tax exemption the government is providing the public. If the plan is to reinvest your funds into more real estate, you are severely hindering yourself by not taking advantage of the 1031 exchange.

We prioritize working with sponsors who have a holistic view of their properties. This

means that our partners take a comprehensive approach to property management and investment strategies, considering various factors that can impact the success of the

investment.

Our Sponsors look beyond the immediate financial returns and understand the importance of factors such as location, market trends, tenant demographics, and property condition.

The following are examples of just a few of the sponsors we work with. For a full list

and current specific offerings, please register for our investment Deal Center.

The above illustration is intended to demonstrate hypothetical mathematical principals, and it is not a guarantee of performance. There can be no certainty that any investment will achieve its stated objectives.

Capital gains and depreciation recapture taxes can be deferred indefinitely through the use of 1031 exchanges. This tax burden can be avoided permanently through a “step up in basis,” whereby heirs inherit property and realize a basis adjustment to the current market value as of the date at death or alternate valuation date. Heirs realize gains and taxes on sales only on those gains above this new, potentially higher valuation. Additionally, the heirs receive a new depreciation schedule, which can be utilized to shelter the property’s income from taxes.

Every year, hundreds of thousands of investors subject themselves to the anxiety that comes with the challenge of completing a 1031 exchange. IRS imposed deadlines and the challenge of finding a “Goldilocks” property can be a daunting to an investor. That anxiety, however, is avoidable by working with a trusted advisor and planning ahead.

Limited Timeframe To Identify Replacement Properties

High·Risk Of Unsuccessful Close

Can Be Difficult To Diversify Portfolio

No Guarantee That Replacement Can Equal Success

Investor Could Be Limited To Local Properties

Sole-ownership is the most direct and controlling form of ownership, whereby the owner holds direct title to the entire asset and is able to make all decisions regarding its use, financing, and disposition. The benefit and burden of sole-ownership property is direct control/responsibility. The owner is able to make all of the property-level decisions but is also responsible for the liabilities of the property. Typically, to obtain financing for sole-ownership real estate, owners must sign for recourse debt—which obligates them to pay the debt, regardless of what occurs with the asset. Sole-ownership is best for clients who want to manage and control real estate directly and who have a significant net worth with plenty of liquid funds to purchase and properly maintain larger real estate assets.

One limiting factor of sole-ownership is that is does not facilitate diversification for most higher- net-worth real estate investors. In the case of smaller commercial real estate, such as NN or NNN retail properties with national tenants, sole-ownership typically requires a total purchase price of $1,000,000 to $3,000,000 and a down payment of $500,000 to $1,250,000. With many larger, commercial properties, the sky is the limit on both purchase price and down payment requirements. Most larger, institutional-type commercial assets in stronger locations command purchase prices in excess of $15 million with down payments in excess of $6 million.

For institutional and family office clients with a net worth in excess of $30 million, diversification into smaller commercial real estate via the sole-ownership structure may not be an issue because the available investment funds can be significantly greater. Institutions with investable, available assets in excess of $1 billion are able to build relatively diversified portfolios in both small and large commercial real estate. For most individuals with a net worth of $30 million or less, the sole-ownership investment structure greatly limits the level of diversification possible.

Tenant-in-Common (TIC) ownership references a way of taking title to real estate with each owner possessing an undivided, fractional interest in an entire property. Tenant-in-Common investment structures began in the 1600s in England. They provided real estate investors an alternative to partnerships. They are popular because of their tax-deferred exchange qualifications. In the past 9 years, the Tenant-in-Common structure has been packaged as an investment security, and it has become common for individual real estate investors in completing their 1031 exchanges.

As the nation’s real estate market heated up through the early to mid 2000s, 1031 exchange investing became even more popular. However, the IRS-imposed time restrictions on the 1031 exchange became difficult for investors to meet. As a result, the Tenant-in-Common structure began to be packaged more regularly as a security in early 2001 and 2002. Investors were able to make much smaller investments to access commercial and institutional quality real estate to complete their 1031 exchange. Furthermore, many Tenant-in-Common properties came “pre-packaged” with due diligence information and financing already in place. This allowed investors to more easily identify and close on investment real estate and comply with the 1031 guidelines.

Whether a Tenant-in-Common structure is applied with two investors or up to 35 investors (the IRS limit), the structure and setup are the same. Owners possess an undivided interest in the property according to their proportionate investment and are able to receive 100% of their share of the potential cash flow, tax benefits, and sale profits from the property.

Similar to the Tenant-in-Common structure, the Delaware Statutory Trust (DST) provides a means of real estate ownership that is undivided, fractional, and compatible with a 1031 tax-deferred exchange. In October of 2004, the IRS provided revenue ruling 2004-86, which defined the Delaware Statutory Trust structure as eligible to be like-kind property. Delaware Statutory Trusts also can be syndicated like Tenant-in-Common investments so that the due diligence information, financing, and closing can be coordinated to accommodate the needs of the 1031 exchange timelines.

In a Tenant-in-Common structure, each owner holds title to the real estate directly. In a Delaware Statutory Trust structure, each investor holds title to the real estate through a beneficial interest in the trust. The DST structure is completely passive. All major property decisions are made by the trustee of the trust and the asset manager, rather than by vote of the Tenant-In- Common owners.

The Delaware Statutory Trust is not limited to 35 investors. It is able to accommodate up to 499 investors. Most firms that provide DST investments do not allow 499 investors in any one asset. But even allowing 50 or 100 investors (up from the 35 person limit of a Tenant-in-Common) can dramatically decrease the minimum investment required for these types of investments. Typically, the minimum investment for DST-structured real estate is $25,000 to $50,000. This accommodates greater diversification opportunities for the individual investor.

The Delaware Statutory Trust is an investment structure appropriate for clients seeking entirely passive ownership in real estate. This investment structure is typically best suited for individuals with a net worth greater than $1 million (excluding primary residence) or who meet certain income thresholds who require 1031-compatible replacement property and are targeting the possibility of stable income-producing real estate assets with a longer-term hold period and active, third-party professional management.