Despite unique risks and considerations, alternative investments can potentially be useful tools to improve the risk-return characteristics of an investment portfolio. They can potentially increase diversification and reduce volatility, given historically low correlations to more traditional investments; they can offer the potential for enhanced returns due to the wider investment opportunity set; and they can hedge certain portfolio exposures, thereby reducing concentration risk.

The question then becomes why are investors unwilling to include alternatives in their portfolios. Is it because they do not fully understand the benefits, risks, costs, and liquidity of the opportunities? While the answer is different for every investor, the principals of Breakwater Capital can help you determine if alternative investments may be right for you.

Alternative investments have long been used to attempt to offset the constant ebbs and flows of the conventional market. This makes them worth considering as a tool to insulate your portfolio against sudden dips onset by major incidents that cannot be controlled or predicted, aka Black Swan events. Taking risk out of investing is impossible, however we can help further diversify your investment portfolio by leveraging our many relationships in this industry and recommending what we believe to be appropriate funds based upon your specific investment situation and profile.

Given the potential benefits of alternative investments, we find it interesting that the typical individual investor has little to no exposure, whereas large institutions have a significant portion of their portfolios allocated to alternatives.

Results show funds with the highest percentage of assets in alternative investments have historically performed the best over 10 and 20 year periods.

Source: “Investing Like the Harvard and Yale Endowment Funds” by Michael W. Azlen, CAIA and Ilan Zermati of Frontier Investment Management. “The referenced study includes only those funds identified above. There is no guarantee that any investment or fund will achieve similar performance or its stated objectives, and they may, in fact, lose money including the potential of all principal invested.”

Accredited real estate investors are in a unique position to diversify their investment strategy through private real estate funds. We offer a range of options to fit your circumstances, lifestyle needs, and financial objectives.

Preferred equity, or preferred stock, is often considered a hybrid security. While it shares many characteristics with debt instruments, it also offers investors the opportunity to seek to mitigate risk. Unlike common equity, preferred equity investors have the possibility of receiving a fixed annual return on their initial investment, and the potential for cash flow distributions are received prior to common stock shareholders. These options are attractive to investors as they target higher-fixed income payments, and shareholders have priority claim over dividends and liquidation proceeds if a company defaults.

Companies leverage preferred equity as a unique form to finance real estate investments or developments. There are different types of preferred equity, offering investors the potential for varying returns and risks. The most common include cumulative, callable, convertible, participating, and adjustable-rate preferred stock (ARPS).

A real estate investment trust, or REIT, is a corporation that owns and/or manages income-producing commercial real estate. When individuals buy a real estate investment trust (REIT) share, they are purchasing a share of the company that owns and manages the rental property. Shares of publicly traded REITs can be purchased and sold as easily as other stocks, even on a daily basis, thereby providing significant liquidity to investors.

Many types of REITs exist. Most focus on a specific product type (e.g., retail, hospitality, multifamily housing, senior living facilities, student housing, office space, self-storage, industrial, and so on) or geography (e.g., commercial real estate in the Northeast vs. Southwest).

Interval Funds

An interval fund is a type of closed-end fund that offers liquidity to investors at stated intervals – typically quarterly, semi-annually, or annually. This means investors can sell a portion of their shares at regular intervals at a price based on the fund’s net asset value. However, there is no guarantee that investors can redeem their shares during a given redemption period. As such, interval funds should generally be treated as long-term investments that, in turn, will usually offer the potential for an illiquidity premium in exchange.

Interval funds can be used to invest in many securities and asset classes, including, but not limited to, real estate. A single interval fund is not limited to investing in a single asset class; in fact, it can invest in various assets as a means of diversifying its holdings.

A real estate income fund is a specific subset of funds that focuses exclusively on investing in income-generating real estate. Real estate income funds provide another entry point for those looking to invest cash in large commercial real estate portfolios. Real estate income funds are particularly appealing to retail investors who want to own institutional-quality real estate that would otherwise be out of reach to them. A real estate income fund pools capital from many investors, and then the fund’s sponsor oversees all of the fund’s activities – from due diligence and underwriting to property renovations, stabilization, ongoing management, and eventually disposition. Depending on the nature of a real estate income fund, the fund can have different investment minimums as well as lengthy hold periods, and, therefore, the capital invested should be considered illiquid during that hold period.

There are dozens, if not hundreds or thousands, of different types of investment funds, including equity funds, bond funds, money market funds, mutual funds, and hedge funds.

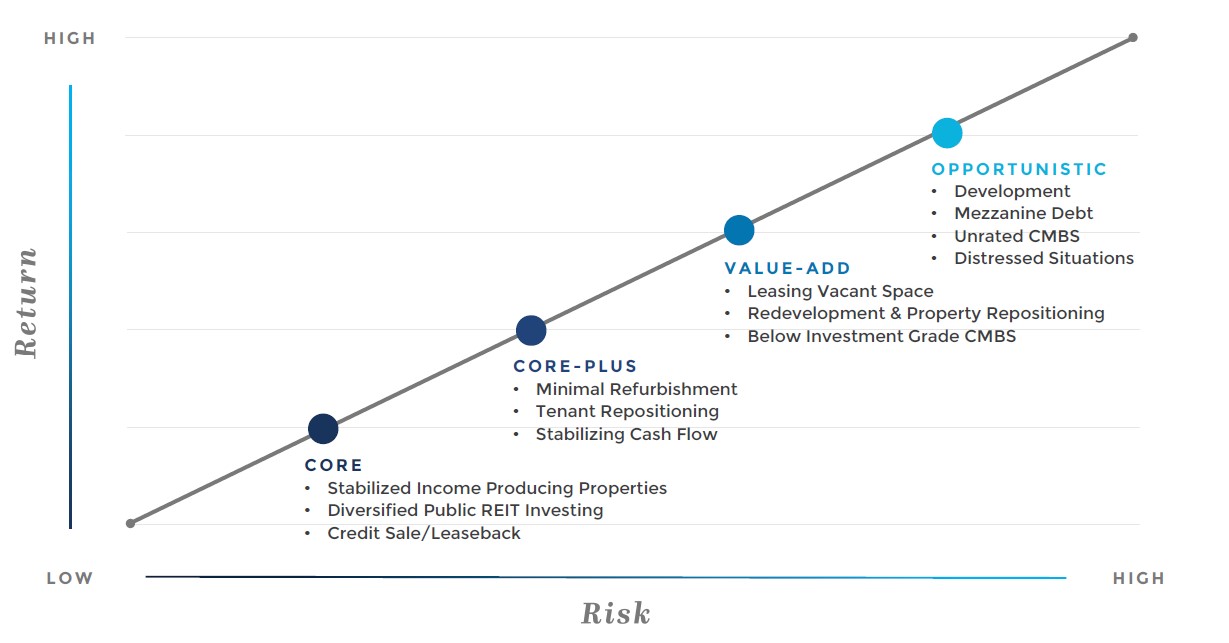

1 Source: https://www.realvantage.co/insights/investing-in-real-estate-know-your-spectrums-first/

2 There can be no assurance that these objectives will be achieved.

Start making more informed choices for your financial future with Breakwater Capital. Schedule a free in-person or virtual consultation so we can get to know each other. During our meeting we will discuss your finances at length to determine if Breakwater Capital is right for you.

Fill out a Contact Form to Request More Information or Schedule a Consultation

9940 Research Dr. Suite 200 Irvine, CA 92618

(310) 940-9430

Josh@Breakwater1031.com

Sign up to receive the latest1031 Exchange Deals and news from Breakwater Capital.

All investing involves risk of loss of some or all principal invested. Past performance is not indicative of future performance. There can be no guarantee that any investment or strategy will achieve its stated objectives. Speak to your tax and/or financial professional prior to investing. Securities and advisory services through Emerson Equity LLC, member FINRA and SIPC and a registered investment adviser. Emerson is not affiliated with any other entity identified herein.

There is no guarantee that any strategy will be successful or achieve investment objectives; Potential for property value loss – All real estate investments have the potential to lose value during the life of the investments; Change of tax status – The income stream and depreciation schedule for any investment property may affect the property owner’s income bracket and/or tax status. An unfavorable tax ruling may cancel deferral of capital gains and result in immediate tax liabilities; Potential for foreclosure – All fnanced real estate investments have potential for foreclosure; Illiquidity –These assets are commonly offered through private placement offerings and are illiquid securities. There is no secondary market for these investments;Reduction or Elimination of Monthly Cash Flow Distributions – Like any investment in real estate, if a property unexpectedly loses tenants or sustains substantial damage, there is potential for suspension of cash flow distributions; Impact of fees/expenses – Costs associated with the transaction may impact investors’ returns and may outweigh the tax benefts. Stated tax benefts – Any stated tax benefts are not guaranteed and are subject to changes in the tax code. Speak to your tax professional prior to investing.

Investing in opportunity zones is speculative. Opportunity zones are newly formed entities with no operating history. There is no assurance of investment return, property appreciation, or profits. The ability to resell the fund’s underlying investment properties or businesses is not guaranteed. Investing in opportunity zone funds may involve a higher level of risk than investing in other established real estate offerings. Long-term investment. Opportunity zone funds have illiquid underlying investments that may not be easy to sell and the return of capital and realization of gains, if any, from an investment will generally occur only upon the partial or complete disposition or refinancing of such investments. Limited secondary market for redemption. Although secondary markets may provide a liquidity option in limited circumstances, the amount you will receive typically is discounted to current valuations. Difficult valuation assessment. The portfolio holdings in opportunity zone funds may be difficult to value because financial markets or exchanges do not usually quote or trade the holdings. As such, market prices for most of a fund’s holdings will not be readily available. Capital call default consequences. Meeting capital calls to provide managers with the pledged capital is a contractual obligation of each investor. Failure to meet this requirement in a timely manner could elicit significant adverse consequences, including, without limitation, the forfeiture of your interest in the fund. Leverage. Opportunity zone funds may use leverage in connection with certain investments or participate in investments with highly leveraged capital structures. Leverage involves a high degree of financial risk and may increase the exposure of such investments to factors such as rising interest rates, downturns in the economy or deterioration in the condition of the assets underlying such investments. Unregistered investment. As with other unregistered investments, the regulatory protections of the Investment Company Act of 1940 are not available with unregistered securities. Regulation. It is possible, due to tax, regulatory, or investment decisions, that a fund, or its investors, are unable realize any tax benefits. You should evaluate the merits of the underlying investment and not solely invest in an opportunity zone fund for any potential tax advantage.