Case Uses

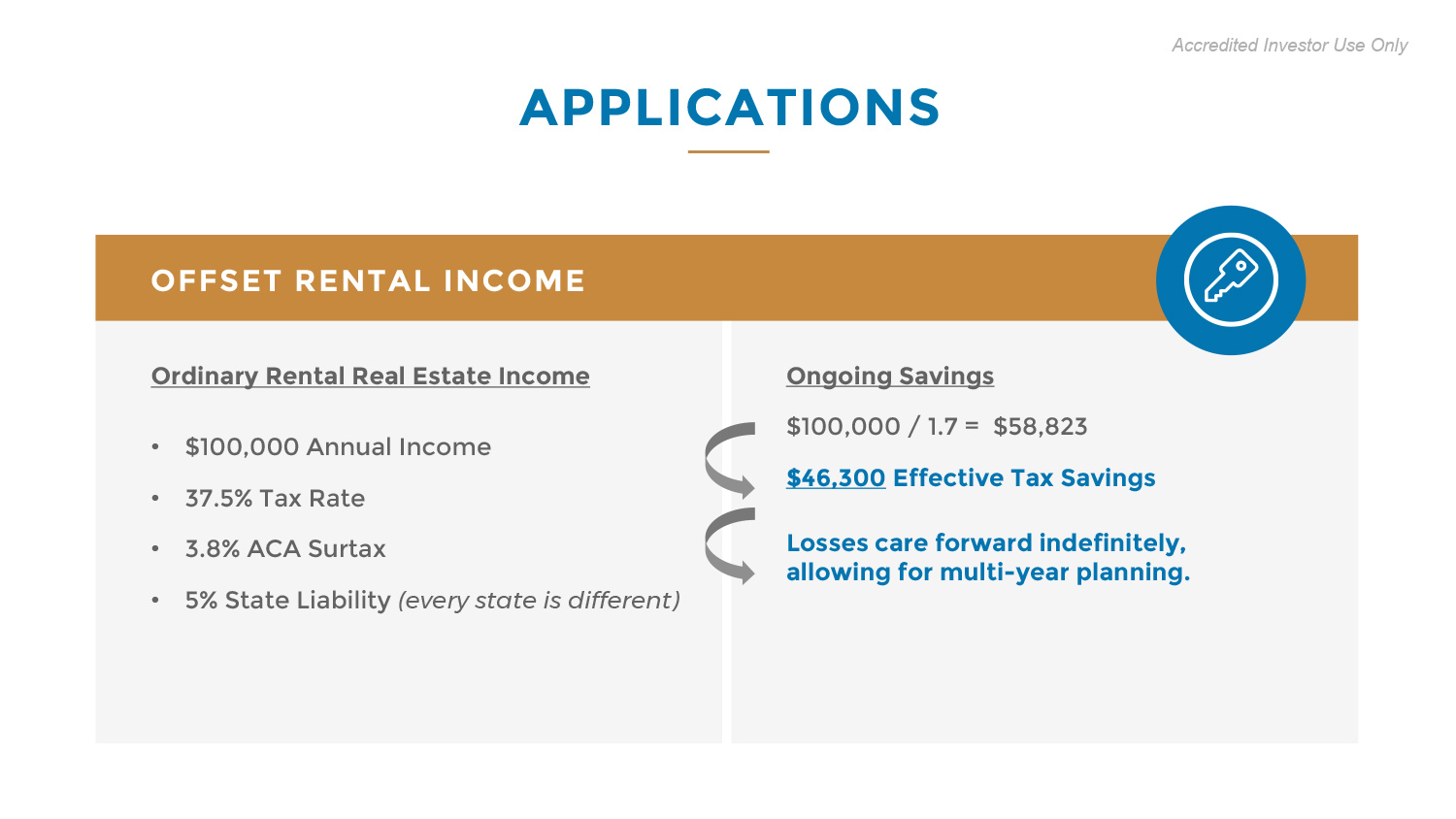

While real estate is typically viewed as an appreciating asset in the eyes of investors, from a tax perspective, the components of the building are depreciating assets that are eligible for tax write-offs over their useful life.

Start making more informed choices for your financial future with Breakwater Capital. Schedule a free in-person or virtual consultation so we can get to know each other. During our meeting we will discuss your finances at length to determine if Breakwater Capital is right for you.

Fill out a Contact Form to Request More Information or Schedule a Consultation

9940 Research Dr. Suite 200 Irvine, CA 92618

(310) 940-9430

Josh@Breakwater1031.com

Sign up to receive the latest1031 Exchange Deals and news from Breakwater Capital.

All investing involves risk of loss of some or all principal invested. Past performance is not indicative of future performance. There can be no guarantee that any investment or strategy will achieve its stated objectives. Speak to your tax and/or financial professional prior to investing. Securities and advisory services through Emerson Equity LLC, member FINRA and SIPC and a registered investment adviser. Emerson is not affiliated with any other entity identified herein.

There is no guarantee that any strategy will be successful or achieve investment objectives; Potential for property value loss – All real estate investments have the potential to lose value during the life of the investments; Change of tax status – The income stream and depreciation schedule for any investment property may affect the property owner’s income bracket and/or tax status. An unfavorable tax ruling may cancel deferral of capital gains and result in immediate tax liabilities; Potential for foreclosure – All fnanced real estate investments have potential for foreclosure; Illiquidity –These assets are commonly offered through private placement offerings and are illiquid securities. There is no secondary market for these investments;Reduction or Elimination of Monthly Cash Flow Distributions – Like any investment in real estate, if a property unexpectedly loses tenants or sustains substantial damage, there is potential for suspension of cash flow distributions; Impact of fees/expenses – Costs associated with the transaction may impact investors’ returns and may outweigh the tax benefts. Stated tax benefts – Any stated tax benefts are not guaranteed and are subject to changes in the tax code. Speak to your tax professional prior to investing.

Investing in opportunity zones is speculative. Opportunity zones are newly formed entities with no operating history. There is no assurance of investment return, property appreciation, or profits. The ability to resell the fund’s underlying investment properties or businesses is not guaranteed. Investing in opportunity zone funds may involve a higher level of risk than investing in other established real estate offerings. Long-term investment. Opportunity zone funds have illiquid underlying investments that may not be easy to sell and the return of capital and realization of gains, if any, from an investment will generally occur only upon the partial or complete disposition or refinancing of such investments. Limited secondary market for redemption. Although secondary markets may provide a liquidity option in limited circumstances, the amount you will receive typically is discounted to current valuations. Difficult valuation assessment. The portfolio holdings in opportunity zone funds may be difficult to value because financial markets or exchanges do not usually quote or trade the holdings. As such, market prices for most of a fund’s holdings will not be readily available. Capital call default consequences. Meeting capital calls to provide managers with the pledged capital is a contractual obligation of each investor. Failure to meet this requirement in a timely manner could elicit significant adverse consequences, including, without limitation, the forfeiture of your interest in the fund. Leverage. Opportunity zone funds may use leverage in connection with certain investments or participate in investments with highly leveraged capital structures. Leverage involves a high degree of financial risk and may increase the exposure of such investments to factors such as rising interest rates, downturns in the economy or deterioration in the condition of the assets underlying such investments. Unregistered investment. As with other unregistered investments, the regulatory protections of the Investment Company Act of 1940 are not available with unregistered securities. Regulation. It is possible, due to tax, regulatory, or investment decisions, that a fund, or its investors, are unable realize any tax benefits. You should evaluate the merits of the underlying investment and not solely invest in an opportunity zone fund for any potential tax advantage.