1. Rated by Egan Jones Ratings, December 14, 2023

*Please see page 2 for risk factors for comparison of a Direct Title Security, Delaware Statutory Trust, and Direct Estate Ownership for key differences and considerations..

A Direct Title Security is an investment structure that represents an investor’s 100% ownership of the equity in a single-member limited liability company (LLC) formed to acquire the individual home or homes.

Each Direct Title Security owns a Property with:

Each Offer to Purchase a DTS, lnvestors Receive the Following:

A Direct Title Security Offers Certain Unique Advantages with the Same Tax Deferral Strategies as Investment Structures you Already Know.

1. Rated by Egan Jones Ratings, December 14, 2023

*Please see page 2 for risk factors for comparison of a Direct Title Security, Delaware Statutory Trust, and Direct Estate Ownership for key differences and considerations..

Homes Ranging from $250-500K in Growing Metropolitan Statistical Areas (MSAs)

This Direct Title Security Offering is Structured to be Eligible for Tax Deferral Under IRC Section 1031

Full Title Control at Exit with the Ability to Sell the Home with the Lease in Place

Custom Financing Options Available to Meet 1031 Exchange Requirements

Investors Receive a Payment Every Month for the Duration of the NNN Lease Term

Each Lease Includes Annual Rent Increases Built in to the Lease Agreement

Investor can sell their property or perform a 721 Exchange into the Sponsor’s REIT at any time

Investor can refinance their property and pull out money tax-free, or sell properties off one at a time

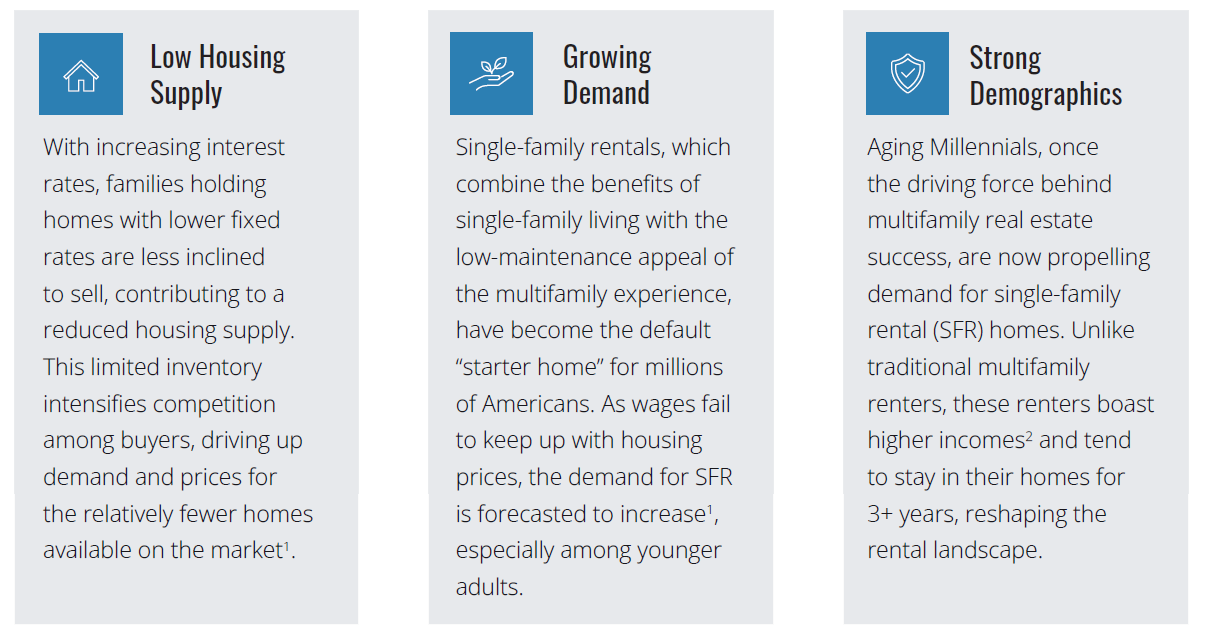

1. CBRE Research, CBRE Econometric Advisors, Census Bureau, January 2023.

2. John Burns Research and Consulting, LLC, tabulations of US Census Bureau Current Population Survey Annual Social and Economic Supplement via IPUMS-USA (Data: 2022, Pub: Mar-24)

3-5 Bed | 2-4 Bath

1,200 – 2,500 Square Feet

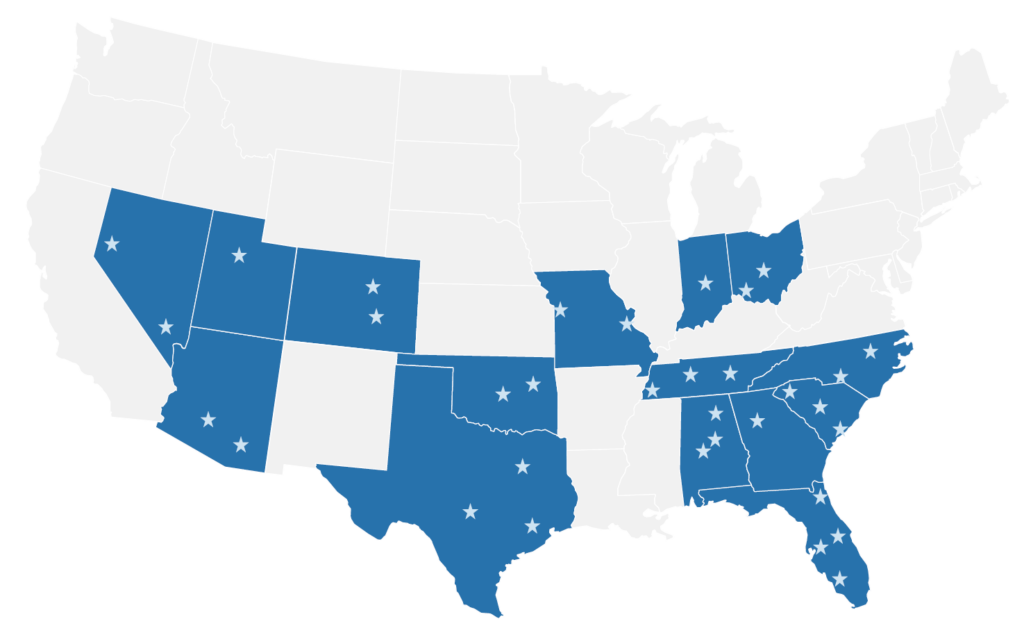

Midwest Sunbelt Markets with

GreatSchools Rating over 4 and Strong Local Economies

$250,000 – $500,000

Price Point

Years Built: 2010 – Present

$1,200 Minimum Monthly Rent

GreatSchools is an American national nonprofit organization that provides information about PK-12 schools and education. GreatSchools provides ratings and comparison tools based on student growth, college readiness, equity, and test scores for public schools in the U.S.

Sponsor acquires properties that meet standards in markets and submarkets based on workforce strategy, property potential, safety, and economic trends.

Sponsor makes monthly net lease payments to investors related to the properties held within the Direct Title Security by the 20th of the month1.

Investors will be provided with a combination of financial, non-financial and tax reporting documents, that will be available through an investor portal on an individual basis.

The occupying tenants of the property will experience access to 24/7 customer service for all needs related to the property.

All regular maintenance and any major property renovations that need to occur will be managed and completed by the Property Manager.

The Property Manager will assume all responsibility for leasing, rent collection, repairs & maintenance, capital expenditures, and tax and insurance payments.

Any debt service payments will be deducted from net lease payments.

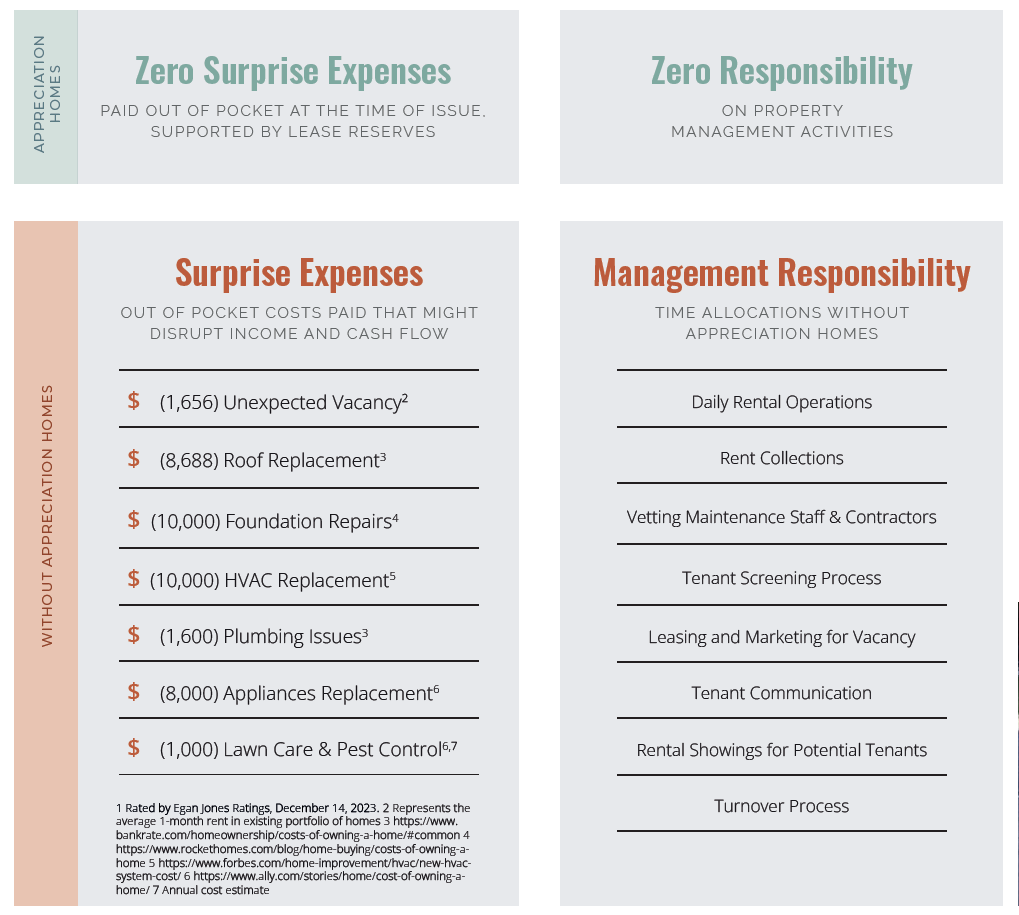

The sponsor is a BBB+ credit-rated1 tenant that assumes responsibility for all labor, time spent, and costs associated with maintaining, owning and leasing the investor’s rental property. Actively managing a rental property involves numerous headaches, from marketing and leasing the property to costly capital expenditures.

Our client owned a single tenant, multi-family property that he wanted to sell and perform a 1031 exchange on. The property was fully paid off and had about $1M in proceeds after closing costs. The investor desired a more passive approach in order to take the day-to-day responsibilities of property management off his plate, however remained adamant on maintaining control over the decision and ability to sell his property sometime in the future.

He was able to select from a portfolio of properties across the nation and ended up selecting 3 properties in 2 different republican leaning states that had laws favoring landlords. His number of properties increased from one to three, and the credit and financial stability of his tenant vastly increased to investment grade. We were even able to increase his cash flow slightly and since he made these selection before escrow closed on his sale, the exchange was simultaneous and there was no interruption of his income.

Furthermore, the client also created a liquidity option should cash be required at some point in time. He has access of up to 65% of his equity via refinancing, which is not a taxable event, and can receive cash in case he ever needs it for any reason.

We also did not have to deal with a bank at any point in time during the entire transaction.

* The scenarios provided herein are meant only to demonstrate principals. There can be no guarantee of performance or that any investment will achieve its stated objectives.

Start making more informed choices for your financial future with Breakwater Capital. Schedule a free in-person or virtual consultation so we can get to know each other. During our meeting we will discuss your finances at length to determine if Breakwater Capital is right for you.

Fill out a Contact Form to Request More Information or Schedule a Consultation

9940 Research Dr. Suite 200 Irvine, CA 92618

(310) 940-9430

Josh@Breakwater1031.com

Sign up to receive the latest1031 Exchange Deals and news from Breakwater Capital.

All investing involves risk of loss of some or all principal invested. Past performance is not indicative of future performance. There can be no guarantee that any investment or strategy will achieve its stated objectives. Speak to your tax and/or financial professional prior to investing. Securities and advisory services through Emerson Equity LLC, member FINRA and SIPC and a registered investment adviser. Emerson is not affiliated with any other entity identified herein.

There is no guarantee that any strategy will be successful or achieve investment objectives; Potential for property value loss – All real estate investments have the potential to lose value during the life of the investments; Change of tax status – The income stream and depreciation schedule for any investment property may affect the property owner’s income bracket and/or tax status. An unfavorable tax ruling may cancel deferral of capital gains and result in immediate tax liabilities; Potential for foreclosure – All fnanced real estate investments have potential for foreclosure; Illiquidity –These assets are commonly offered through private placement offerings and are illiquid securities. There is no secondary market for these investments;Reduction or Elimination of Monthly Cash Flow Distributions – Like any investment in real estate, if a property unexpectedly loses tenants or sustains substantial damage, there is potential for suspension of cash flow distributions; Impact of fees/expenses – Costs associated with the transaction may impact investors’ returns and may outweigh the tax benefts. Stated tax benefts – Any stated tax benefts are not guaranteed and are subject to changes in the tax code. Speak to your tax professional prior to investing.

Investing in opportunity zones is speculative. Opportunity zones are newly formed entities with no operating history. There is no assurance of investment return, property appreciation, or profits. The ability to resell the fund’s underlying investment properties or businesses is not guaranteed. Investing in opportunity zone funds may involve a higher level of risk than investing in other established real estate offerings. Long-term investment. Opportunity zone funds have illiquid underlying investments that may not be easy to sell and the return of capital and realization of gains, if any, from an investment will generally occur only upon the partial or complete disposition or refinancing of such investments. Limited secondary market for redemption. Although secondary markets may provide a liquidity option in limited circumstances, the amount you will receive typically is discounted to current valuations. Difficult valuation assessment. The portfolio holdings in opportunity zone funds may be difficult to value because financial markets or exchanges do not usually quote or trade the holdings. As such, market prices for most of a fund’s holdings will not be readily available. Capital call default consequences. Meeting capital calls to provide managers with the pledged capital is a contractual obligation of each investor. Failure to meet this requirement in a timely manner could elicit significant adverse consequences, including, without limitation, the forfeiture of your interest in the fund. Leverage. Opportunity zone funds may use leverage in connection with certain investments or participate in investments with highly leveraged capital structures. Leverage involves a high degree of financial risk and may increase the exposure of such investments to factors such as rising interest rates, downturns in the economy or deterioration in the condition of the assets underlying such investments. Unregistered investment. As with other unregistered investments, the regulatory protections of the Investment Company Act of 1940 are not available with unregistered securities. Regulation. It is possible, due to tax, regulatory, or investment decisions, that a fund, or its investors, are unable realize any tax benefits. You should evaluate the merits of the underlying investment and not solely invest in an opportunity zone fund for any potential tax advantage.