Please expand on the tabs below to view how various applications of DSTs can be utilized for unique investment & tax strategies.

DST Diversification

Attempting to reduce risk in real estate real estate investments is possible by practicing diversification. Instead of investing in a single property with concentration risk, prudence dictates investing in a number of properties with different investment and risk parameters.

By investing in different asset classes, different locations and properties leased by different tenants, you may be able to mitigate certain risks associated with investing in a concentrated investment. By diversifying your holding periods, all of your investments will not mature and have to be sold at the same time. If you invest in Delaware Statutory Trusts, it also is practical to diversify by sponsorship so that your assets are not all managed by the same real estate firm.

DST IN ACTION

A sample six-property diversified DST portfolio is shown below. This illustrates investment in a more diversified portfolio of DST replacement properties that could qualify for tax deferral under Section 1031.

A diversified portfolio such as this would not be possible with “whole” properties for an exchanger with only $1 million of equity. More exchangers can diversify by using DSTs to acquire interests in investment-grade properties, it’s possible for a larger number of exchangers to diversify. In this way, DSTs can be used to reduce investment risk.

IN CONCLUSION

Bottom Line: Investors who own a more diversified portfolio enjoy reduced risk, especially during challenging economic times, when compared with investors in a single asset. Section 1031 exchangers acquiring replacement property should diversify to reduce risk. In this way, you can seek to both qualify for tax deferral and reduce the inherent risk of making new real estate investments.

A common strategy to identify replacement properties is the “3 Property Rule,” where an exchanger may identify up to three properties, without regard to their fair market value, within 45 days. Identifying only one property may be dangerous because a property can fall out of escrow for many reasons: financing, inspections, etc. To secure an opportunity

to execute a successful 1031 exchange, the exchanger could identify the first property as defined by the investor/commercial real estate broker. The exchanger can then identify two additional properties owned by DSTs. It costs the exchanger no extra money to identify additional properties. Taking this precaution insures that the exchanger has adequate choices.

PROPERTY #1: PROPERTY IDENTIFIED BY INVESTOR/BROKER

PROPERTY #2: PROPERTY OWNED BY DST

PROPERTY #3: PROPERTY OWNED BY DST

When the 1031 exchange proceeds exceed the purchase price of your like-kind property, DSTs can offer a tax-deferred solution for those left over exchange proceeds. With a minimum investment typically starting at $50,000, DSTs provide an excellent option to invest the remaining funds from your exchange. They will allow you to defer the capital gain on your entire 1031 Exchange and help ensure every dollar is working for you.

Sale Price of Relinquished Property: $2.0 MILLION

Replacement Property #1: $1.8 MILLION PROPERTY IDENTIFIED BY INVESTOR/BROKER

Replacement Property #2: $100,000 INVESTMENT IN PROPERTY OWNED BY DST

Replacement Property #3: $100,000 INVESTMENT IN PROPERTY OWNED BY DST

Result: All $2.0 million is exchanged with no taxable income. The exact dollar amount of the replacement property is a common challenge in 1031 transactions. In one example, the relinquished property sells for $2.0 million and the exchanger identifies a replacement property for $1.8 million. The difference in the price of the relinquished property and the price of the replacement property results in a taxable amount on the remaining $200,000. Under the “3 Property Rule,” DSTs provide a solution:

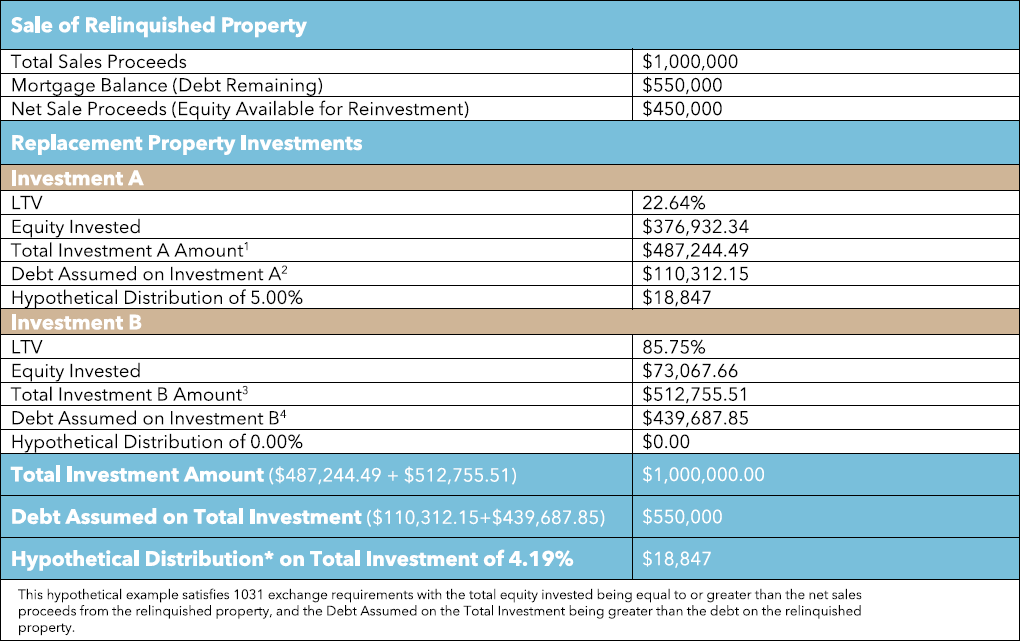

In a 1031 exchange transaction, the debt placed or assumed on the replacement property must be equal to or greater than the debt relieved in the relinquished property. Property owners may run into a road block when they try to get financing on their replacement properties. For example, a property owner may wish to sell an apartment building worth $5 million with $2.5 million in debt, or 50% loan-to-value (LTV). If that property owner cannot get approved for a $2.5 million loan on their replacement property, then most likely the owner will not sell.

The majority of IPC’s programs are structured so that the replacement property is owned by a Delaware Statutory Trust, or DST. The DST is a pass-through entity that owns the real estate assets. When a replacement property is owned by a DST, the DST will be the borrower of any loan and investors in that DST will not need to be individually qualified with a lender.

Potential Solution to Cover 1031 Exchange Debt Requirements

Investors can blend a combination of a highly leveraged property and a cash flow property to exactly meet the debt, equity, and overall requirements of the exchange without having to come up with additional equity. Investors can use a Zero to inexpensively meet the debt requirements of an exchange so that no additional equity is required to meet the overall value requirement.

Highly leveraged, zero cash flow properties (Zeros) are investment structures that help investors easily meet the debt and equity requirements of a 1031 Exchange. These properties have debt service obligations equal to (or nearly equal to) the net operating income of the property. This highly leveraged solution is possible because of the investment grade credit of the tenant and the absolute triple net nature of their long-term leases.

Example: An investor has sold a property for $1,000,000 and would like to do a 1031 Exchange. The Relinquished Property was moderately leveraged netting the seller $450,000 equity for reinvestment. To fulfill the debt requirement of the 1031 Exchange and complete the exchange, the sum of the cash invested, and the debt placed on the Replacement Property must be equal to or greater than the sum of the net cash proceeds, and the debt that was on the Relinquished Property. To meet their need, the investor may choose two Replacement Property investments to complete their Exchange. One with a lower loan -to-value ratio (LTV), the second with a high loan-to-value (LTV). Below, is how a Zero could be utilized to meet this investor’s Exchange Requirement.

INTRODUCTION TO REITS AND OPERATING PARTNERSHIPS

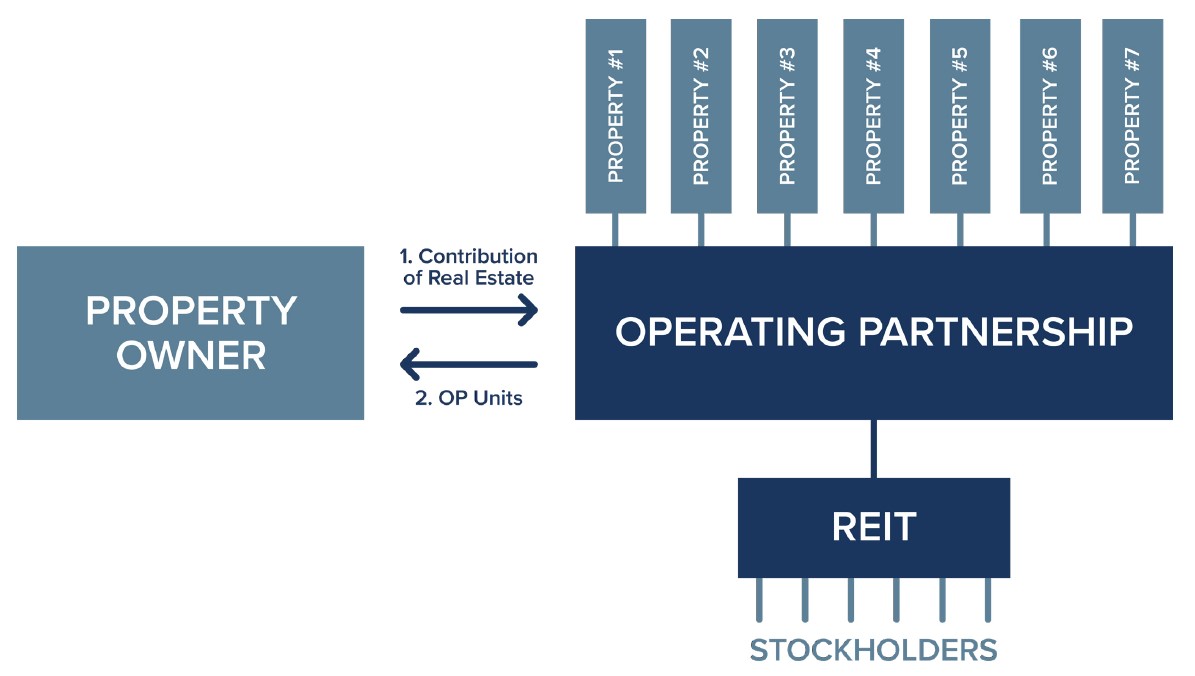

Real estate investment trusts (REITs) typically own their real estate in an operating partnership known as an OP. The OP is structured as a partnership to obtain favorable tax treatment under the Internal Revenue Code. Section 721 of the Code provides favorable treatment for owners who exchange their real estate for OP units. This is commonly referred to as a 721 exchange, OP transaction or UPREIT.

OP Unit holders receive a share of cash flow from each of the properties in the OP. They typically receive the same rate of return on their equity as REIT stockholders receive on their stock.

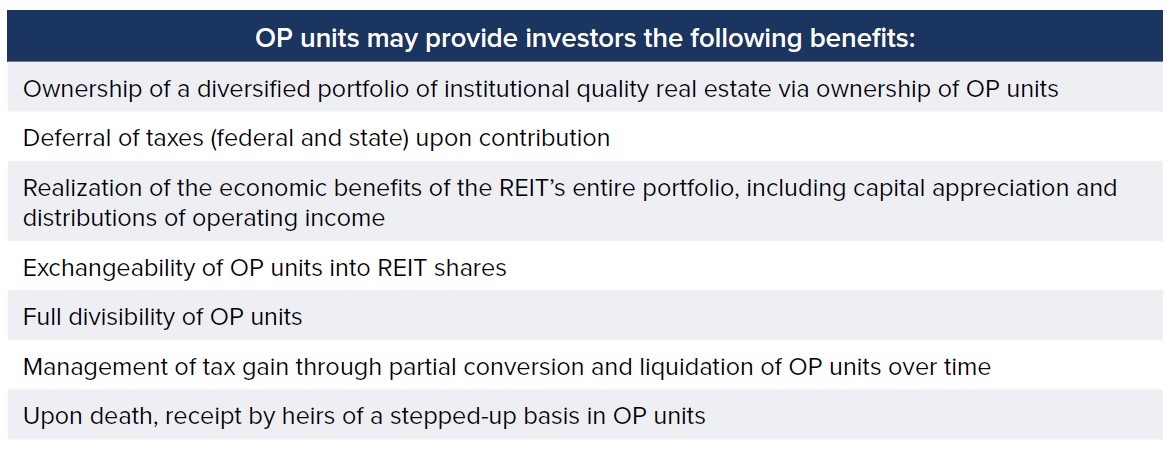

Summarized below are numerous benefits to owners who enter into OP transactions, including the reduction of risk by diversifying compared to ownership of a single property. Also, OP distributions are protected compared to ownership of a single property because the OP owns a large portfolio of properties.

WHAT IS A 721 EXCHANGE/OP TRANSACTION?

In a Section 721 exchange, the owner exchanges real estate for OP units of a REIT. Instead of receiving cash in a taxable transaction, the owner receives OP units. Unlike a taxable sale, the gain is deferred under Section 721.

Section 721 is similar to Section 1031 governing like-kind exchanges, another popular method of deferring gain on the sale of investment real estate. Section 721 exchanges have become a popular strategy among real estate owners looking for diversification and other benefits described below.

TAX BENEFITS OF SECTION 721

Section 721 defers taxation for owners of real estate who contribute their property to an OP. The gain that would be recognized in a taxable sale is deferred. The gain is deferred until the owner elects to sell the OP units in a taxable transaction. The owner has the ability to hold OP units indefinitely or time the sale to coincide with tax or financial planning strategies.

The tax deferral becomes permanent (the tax is essentially forgiven) upon death. The heirs, upon death of the OP holder, receive a stepped-up tax basis in the OP units (tax basis equal to fair market value). This means that the heirs can then sell free of taxes (federal and state). In this way, the deferral becomes permanent upon death.

Section 721 is a popular alternative to a taxable sale for real estate owners interested in a taxfavored investment with an institutional partner.

OP/UPREIT STRUCTURE

A 721 transaction allows an investor to exchange real property for operating partnership units, which may then be converted into REIT shares and sold.

BENEFITS OF SECTION 721 EXCHANGES/OP TRANSACTIONS

Owners of real property enjoy numerous benefits from a 721 exchange:

1. No Taxable Gain. The gain that would be recognized in a taxable sale is deferred under Section 721. The gain is deferred until the holder of OP units elects to sell in a taxable transaction. The gain will be forgiven upon death of the holder.

2. Diversification. Owners who exchange real estate for OP units have the safety net of a more diversified investment because the OP owns a large portfolio of

properties. Owners can reduce their risk by diversifying in this manner compared to ownership of a single property. Also, the OP’s portfolio of properties helps

protect owners’ distributions of cash flow

3. Liquidity. REITs typically provide a liquidity option that is not available in a direct real estate investment. OP units may be exchanged for REIT shares and, then, sold on the market to create liquidity for some or all of the investment. Liquidity in this manner is not available to direct owners of real estate.

4. Estate and Tax Planning. OP units are conducive to estate and tax planning because they can be divided among the partners of a partnership or members

of a family. The divisibility of OP units permits some to hold and others to sell. This flexibility permits individualized tax and financial planning.

5. Passive Investment. Owners are able to convert actively managed real estate into a passive investment where a professionally managed, institutional REIT provides turn-key management and accounting services.

6. Transparency. REITs provide a high level of transparency and oversight by an independent board of directors.

These benefits can be obtained in a 721 exchange without triggering taxable gain (federal or state).

Target Property

For an OP transaction to be a viable strategy, the target property must meet the REIT’s investment criteria. REITs typically acquire investment grade properties and also interests in such properties, for example, DST interests.

HOW IT WORKS

The process is simple. The property owner and the REIT mutually agree on the fair market value for the property. The purchase price is typically determined by independent third-party appraisals.

Debt secured by the real estate will be assumed by the OP or repaid at closing. The owner will be released from all liability on their loan.

The real estate owner receives OP units with a value equal to 100% of their equity in the property (fair market value of the property less any debt assumed by the OP).

THE 721 ADVANTAGE

A Section 721 exchange offers many potential benefits, including:

LIQUIDTY OPTION — EXCHANGE OP UNITS FOR REIT SHARES

REITs typically provide liquidity via an option to exchange OP units for REIT shares that can be sold on the market. To obtain liquidity, the owner would exchange OP units for REIT shares, and then sell shares on the market.

The holder of OP units chooses when and how much of the OP units to sell. The decision to sell is made solely by the holder of OP units. This is a taxable transaction but provides liquidity not otherwise available in a direct real estate investment.

Everyone wants the best possible scenario for their heirs before they pass. Investing in a DST eliminates the opportunity for heirs to argue over what to do with an investment property when the owner passes away. The heirs continue to receive distributions from the investment, if any, and upon the sale of the property owned by the DST, each of the heirs can choose what to do with their inherited portion. One heir can continue to exchange the investment, while another can sell and receive cash proceeds.

Best Candidates

Sellers of commercial real estate who face a large capital gains tax.

Candidates include: owners of appreciated real estate, long-time owners who have taken depreciation expenses over the years, and owners who have carried in a low tax basis from a previous exchange.

In general, two factors that contribute to a large capital gain are appreciation of the property and depreciation taken over time, which lowers the owner’s tax basis.

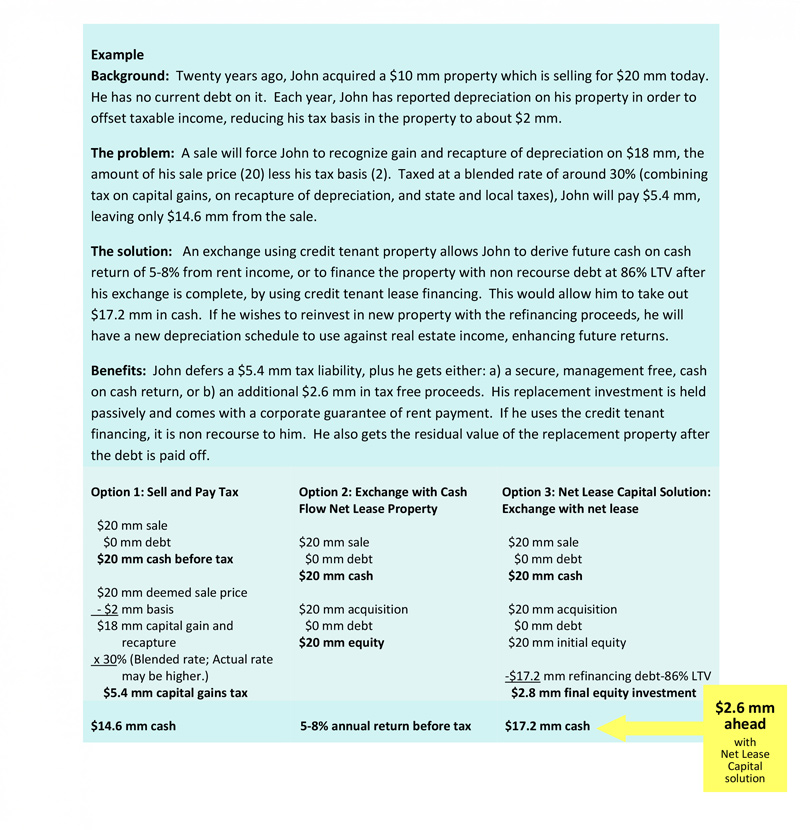

The Problem

Capital gains tax may reduce the seller’s cash proceeds or prevent the seller from selling at all. A 1031 exchange for typical property can defer the tax, but, if the tax basis is low, provides suboptimal outcomes for four reasons:

1) Proceeds are not maximized; sale proceeds are locked up;

2) Little depreciation remains to offset income, since the low tax basis from the sale property is carried into the exchange property. After-tax yields are significantly lower;

3) Risk of failure is high due to strict 1031 timing requirements;

4 ) In instances where owners have lost equity in their properties, more equity is needed to buy replacement property of equal value in order to complete a 1031 exchange, with owners having to come out of pocket.

The Solution

Complete a 1031 exchange using a replacement property net leased for a long term to an investment grade credit tenant.

The liquidity and availability of net lease properties provides certainty in meeting 1031 deadlines, even under tight timeframes.

The property owner may derive significantly more cash from the transaction by refinancing after the exchange is complete, using credit based financing that reaches 86% LTV while mitigating phantom income. By using financing proceeds to make future acquisitions, new property will be acquired at full tax basis so that a full depreciation schedule is available to offset income, enhancing yield.

Traits of the net lease property which help make this solution compelling include:

Breakwater Capital provides property, financing and transaction structures to optimize financial outcomes.

The properties used are management free with investment grade credit tenants on long term leases. Transaction structures eliminate ongoing tax concerns, decrease valuation volatility, and offer easy exit strategies. Breakwater Capital is the nation’s leading expert in this type of transaction, with over $14 billion of transactions closed.

Create an account in minutes and gain access to the entire Breakwater 1031 Marketplace. Members get complete details on all deals – all users can always view 1031 deals with limited information, past deals, and sample offerings.

Start making more informed choices for your financial future with Breakwater Capital. Schedule a free in-person or virtual consultation so we can get to know each other. During our meeting we will discuss your finances at length to determine if Breakwater Capital is right for you.

Fill out a Contact Form to Request More Information or Schedule a Consultation

9940 Research Dr. Suite 200 Irvine, CA 92618

(310) 940-9430

Josh@Breakwater1031.com

Sign up to receive the latest1031 Exchange Deals and news from Breakwater Capital.

All investing involves risk of loss of some or all principal invested. Past performance is not indicative of future performance. There can be no guarantee that any investment or strategy will achieve its stated objectives. Speak to your tax and/or financial professional prior to investing. Securities and advisory services through Emerson Equity LLC, member FINRA and SIPC and a registered investment adviser. Emerson is not affiliated with any other entity identified herein.

There is no guarantee that any strategy will be successful or achieve investment objectives; Potential for property value loss – All real estate investments have the potential to lose value during the life of the investments; Change of tax status – The income stream and depreciation schedule for any investment property may affect the property owner’s income bracket and/or tax status. An unfavorable tax ruling may cancel deferral of capital gains and result in immediate tax liabilities; Potential for foreclosure – All fnanced real estate investments have potential for foreclosure; Illiquidity –These assets are commonly offered through private placement offerings and are illiquid securities. There is no secondary market for these investments;Reduction or Elimination of Monthly Cash Flow Distributions – Like any investment in real estate, if a property unexpectedly loses tenants or sustains substantial damage, there is potential for suspension of cash flow distributions; Impact of fees/expenses – Costs associated with the transaction may impact investors’ returns and may outweigh the tax benefts. Stated tax benefts – Any stated tax benefts are not guaranteed and are subject to changes in the tax code. Speak to your tax professional prior to investing.

Investing in opportunity zones is speculative. Opportunity zones are newly formed entities with no operating history. There is no assurance of investment return, property appreciation, or profits. The ability to resell the fund’s underlying investment properties or businesses is not guaranteed. Investing in opportunity zone funds may involve a higher level of risk than investing in other established real estate offerings. Long-term investment. Opportunity zone funds have illiquid underlying investments that may not be easy to sell and the return of capital and realization of gains, if any, from an investment will generally occur only upon the partial or complete disposition or refinancing of such investments. Limited secondary market for redemption. Although secondary markets may provide a liquidity option in limited circumstances, the amount you will receive typically is discounted to current valuations. Difficult valuation assessment. The portfolio holdings in opportunity zone funds may be difficult to value because financial markets or exchanges do not usually quote or trade the holdings. As such, market prices for most of a fund’s holdings will not be readily available. Capital call default consequences. Meeting capital calls to provide managers with the pledged capital is a contractual obligation of each investor. Failure to meet this requirement in a timely manner could elicit significant adverse consequences, including, without limitation, the forfeiture of your interest in the fund. Leverage. Opportunity zone funds may use leverage in connection with certain investments or participate in investments with highly leveraged capital structures. Leverage involves a high degree of financial risk and may increase the exposure of such investments to factors such as rising interest rates, downturns in the economy or deterioration in the condition of the assets underlying such investments. Unregistered investment. As with other unregistered investments, the regulatory protections of the Investment Company Act of 1940 are not available with unregistered securities. Regulation. It is possible, due to tax, regulatory, or investment decisions, that a fund, or its investors, are unable realize any tax benefits. You should evaluate the merits of the underlying investment and not solely invest in an opportunity zone fund for any potential tax advantage.