While many Exchangers are content to use their local real estate professional to find a property in their own area, others desire a more diversified selection of property types and geographic locations. Some also desire to transition from an active ownership and management role into a more passive one. If that is the case, Breakwater Capital can help you build a diversified portfolio of several different types of like-kind investment properties (multi-family, healthcare, retail, industrial, etc.).

The 45-day identification period moves very quickly and often creates needless stress. Our experienced team of securities and real estate professionals monitors the DST market daily. This means that at any time you have access to a fully-vetted, turnkey 1031 exchange solution where the loan, tenants and cash flow are already in place for a seamless 1031. This streamlined process makes for both a simple and straightforward process.

When you invest l031 money into a DST, you take on partial ownership of the equity and debt. These sample clients’ investments provide tangible examples of what your DST could potentially look like.

Sold Beach House.

Exchanged Into DST (10% Owner)

Equity

$800,000

Debt

$1,200,000

Debt

$1,200,000

Sold Industrial Building.

Exchanged Into DST (5% Owner)

Equity

$1,200,000

Debt

$1,800,000

Debt

$3,000,000

DSTs were created specifically for those seeking to perform a 1031 exchange, but also designed for the tax sensitive investor seeking income, capital preservation and a more conservative approach (with appreciation secondary).

Most DSTs employ an LTV between 0% to 60%

The property must meet certain occupancy thresholds before it comes out to investors.

Sponsors cannot employ high-speculation tactics like ground-up developments or deep value-adds.

Since DSTs cannot deploy significant capital expenditures to create value, most properties are either new/recent builds or have been rehabbed in the recent past.

DSTs cannot ask investors for more money at any point in time. Therefore, each DST begins with ample reserves to account for any unforeseen circumstances or shortfalls in operating income.

The DST is the single owner and agile decision maker on behalf of investors.

DSTs allow investors to acquire partial ownership in properties that otherwise would be out-of-reach.

Loans are nonrecourse to the investor. The DST is the sole borrower.

Investors can divide their investment among multiple DSTs, which may provide for a more diversified real estate portfolio across geography and property types.

The DST structure allows the investor to continue to exchange real properties over and over again until the investor’s death.

Can close in as little as 3-5 business days with no interaction with a bank and possibly continue your cash flow uninterrupted as soon as the following month.

As long as there is available equity, exchangers can make reservations in a given DST until their sale closes. Should they change their mind or if their sale doesn’t close, the investor is not obligated to the sponsor, nor will they be charged any penalties.

Not for those seeking outsized returns in a short amount of time or are pursuing aggressive growth strategies (developing or deep value adds).

Not for investors who need 100% control.

Interests of a DST should be considered illiquid just like any other real estate, especially if you invest via a 1031 exchange.

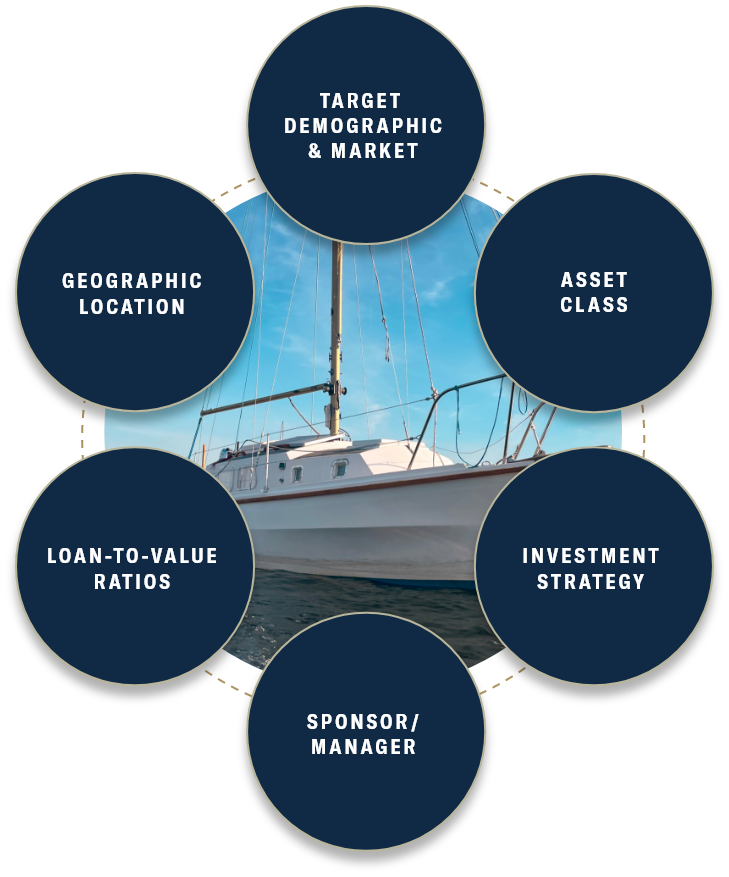

Attempting to reduce risk in real estate real estate investments is possible by practicing diversification. Instead of investing in a single property with concentration risk, prudence dictates investing in a number of properties with different investment and risk parameters.

By investing in different asset classes, different locations and properties leased by different tenants, you may be able to mitigate certain risks associated with investing in a concentrated investment. If you invest in DSTs, it also is practical to diversify by sponsorship so that your assets are not all managed by the same real estate firm.

The DST sponsor leverages their strong lender relationships to attempt to obtain financing terms investors would most likely not be able to obtain on their own.

The DST Assigns The Benefits Of The Debt But Retains The Obligations. The Debt Is Non–Recourse To The Investor. The Investor Does Not Need To Qualify For The Debt Personally.

Investors fulfill their debt requirements without the headache associated with qualifying for and being liable for the debt obligations.

One of the single greatest advantages of utilizing DSTs in a 1031 exchange is the power to diversify your investment. In the example below, we took an investor exchanging their single-family rental into multiple DSTs. They are still taking on similar real estate risk, but are now more diversified in several aspects: Number of properties & tenants, multiple geographic locations and a balanced mix of asset classes and managers.

John & Cindy, a married couple in their 60’s, owned several rental properties in Southern California that had done quite well. Even though they were making a good income, one property in particular was aging and needed some work in order to attract the quality tenant that John & Cindy were accustomed to. Now a decision had to be made; either spend a considerable amount to make the improvements, or sell the property and pay massive capital gains taxes. John was aware of the concept of a 1031 exchange, but the complexities and timing issues were preventing him from taking full advantage of it.

By utilizing a 1031 exchange we were able to reinvest the proceeds from the sale of their property into three different DSTs. Each of these properties were institutional quality assets utilizing different strategies located in multiple states. Furthermore, their was no 1031 exchange risk or an interruption in rental income for John & Cindy.

John & Cindy were very satisfied with the fact that they were now much more diversified investors and not having to rely on just a handful on tenants. In addition, their after-tax net income from the property increased from approximately $45,000 annually to over $60,000 annually. John & Cindy also loved that they no longer had to manage the day to day issues that came with the property and had more time to enjoy their retirement together.

The hypothetical scenarios provided herein are meant only to demonstrate mathematical principals. There can be no guarantee of performance or that any investment will achieve its stated objectives.

Start making more informed choices for your financial future with Breakwater Capital. Schedule a free in-person or virtual consultation so we can get to know each other. During our meeting we will discuss your finances at length to determine if Breakwater Capital is right for you.

Fill out a Contact Form to Request More Information or Schedule a Consultation

9940 Research Dr. Suite 200 Irvine, CA 92618

(310) 940-9430

Josh@Breakwater1031.com

Sign up to receive the latest1031 Exchange Deals and news from Breakwater Capital.

All investing involves risk of loss of some or all principal invested. Past performance is not indicative of future performance. There can be no guarantee that any investment or strategy will achieve its stated objectives. Speak to your tax and/or financial professional prior to investing. Securities and advisory services through Emerson Equity LLC, member FINRA and SIPC and a registered investment adviser. Emerson is not affiliated with any other entity identified herein.

There is no guarantee that any strategy will be successful or achieve investment objectives; Potential for property value loss – All real estate investments have the potential to lose value during the life of the investments; Change of tax status – The income stream and depreciation schedule for any investment property may affect the property owner’s income bracket and/or tax status. An unfavorable tax ruling may cancel deferral of capital gains and result in immediate tax liabilities; Potential for foreclosure – All fnanced real estate investments have potential for foreclosure; Illiquidity –These assets are commonly offered through private placement offerings and are illiquid securities. There is no secondary market for these investments;Reduction or Elimination of Monthly Cash Flow Distributions – Like any investment in real estate, if a property unexpectedly loses tenants or sustains substantial damage, there is potential for suspension of cash flow distributions; Impact of fees/expenses – Costs associated with the transaction may impact investors’ returns and may outweigh the tax benefts. Stated tax benefts – Any stated tax benefts are not guaranteed and are subject to changes in the tax code. Speak to your tax professional prior to investing.

Investing in opportunity zones is speculative. Opportunity zones are newly formed entities with no operating history. There is no assurance of investment return, property appreciation, or profits. The ability to resell the fund’s underlying investment properties or businesses is not guaranteed. Investing in opportunity zone funds may involve a higher level of risk than investing in other established real estate offerings. Long-term investment. Opportunity zone funds have illiquid underlying investments that may not be easy to sell and the return of capital and realization of gains, if any, from an investment will generally occur only upon the partial or complete disposition or refinancing of such investments. Limited secondary market for redemption. Although secondary markets may provide a liquidity option in limited circumstances, the amount you will receive typically is discounted to current valuations. Difficult valuation assessment. The portfolio holdings in opportunity zone funds may be difficult to value because financial markets or exchanges do not usually quote or trade the holdings. As such, market prices for most of a fund’s holdings will not be readily available. Capital call default consequences. Meeting capital calls to provide managers with the pledged capital is a contractual obligation of each investor. Failure to meet this requirement in a timely manner could elicit significant adverse consequences, including, without limitation, the forfeiture of your interest in the fund. Leverage. Opportunity zone funds may use leverage in connection with certain investments or participate in investments with highly leveraged capital structures. Leverage involves a high degree of financial risk and may increase the exposure of such investments to factors such as rising interest rates, downturns in the economy or deterioration in the condition of the assets underlying such investments. Unregistered investment. As with other unregistered investments, the regulatory protections of the Investment Company Act of 1940 are not available with unregistered securities. Regulation. It is possible, due to tax, regulatory, or investment decisions, that a fund, or its investors, are unable realize any tax benefits. You should evaluate the merits of the underlying investment and not solely invest in an opportunity zone fund for any potential tax advantage.