An Efficient Strategy

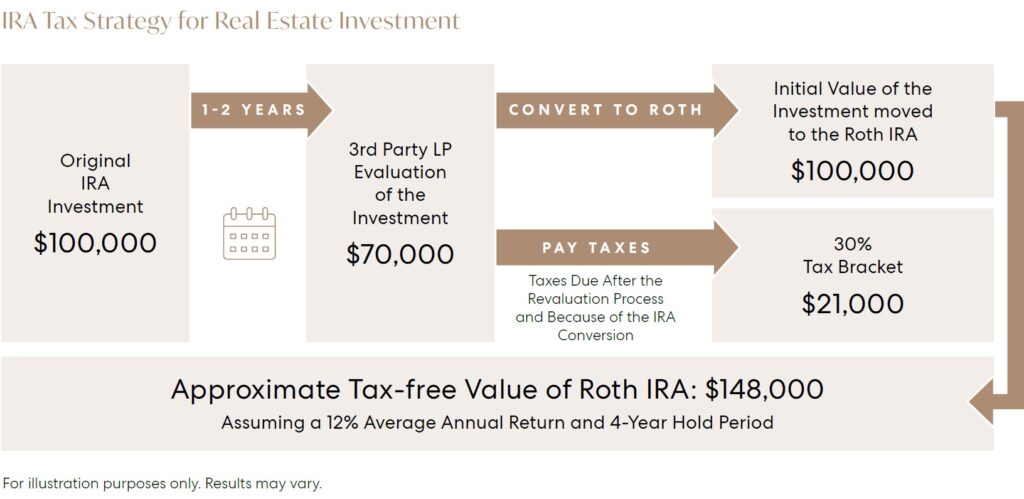

Here is why this strategy can be especially effective with investments in real estate under development:

Private placements must receive an annual valuation under ERISA guidelines

A point-in-time valuation on a partially completed project often values at 50%-75% of the original investment during the construction phase.